Valoris is eligible to the Portuguese Residency and citizenship by investment program – Golden Visa.

The purpose of the Fund is to offer an open-ended structure with two distinct portfolios — “Moderated” (debt-focused) and “Enhanced” (debt and equity) — allowing investors to align their participation with their individual risk and return profiles.

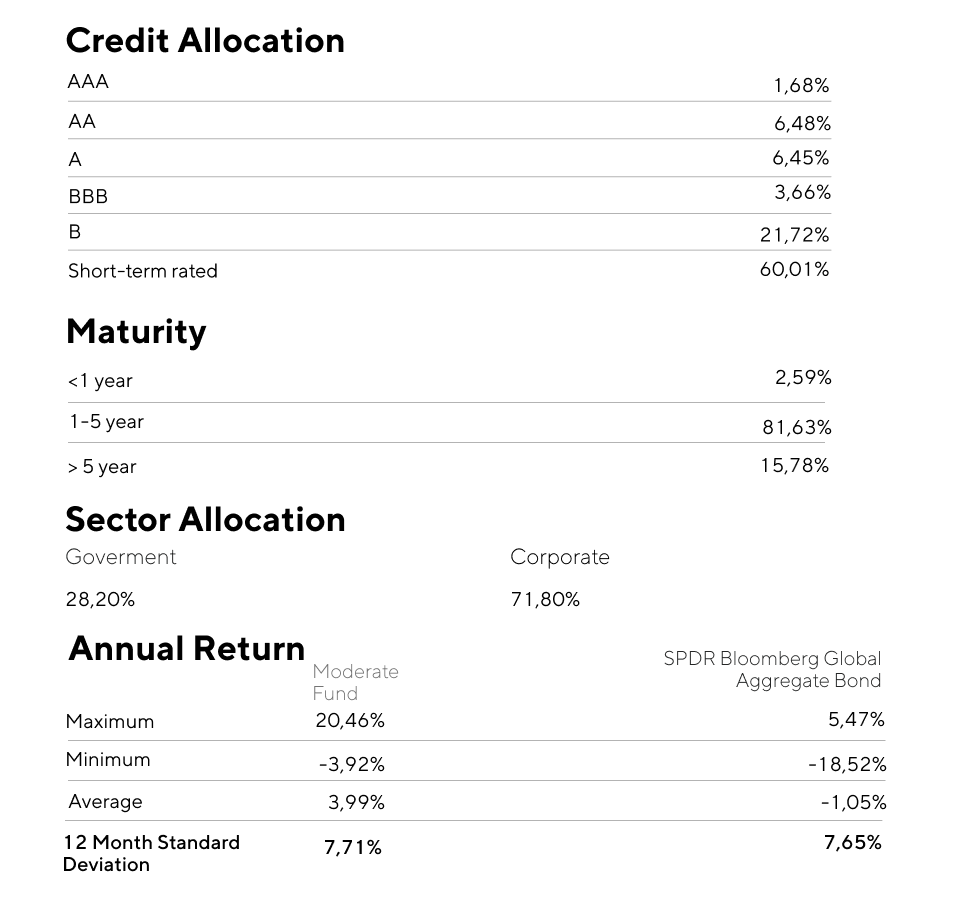

The moderated Portefolio

This fund is eligible for Golden Visa - 60% of its allocation is done through Portuguese government and corporate bonds

The portfolio with 100% exposure to fixed income through direct securities and passive funds prioritising capital preservation and income stability, while offering growth potential with a low volatility.

This fund is suited for risk-averse investors or those who want to preserve capital with inflation protection.

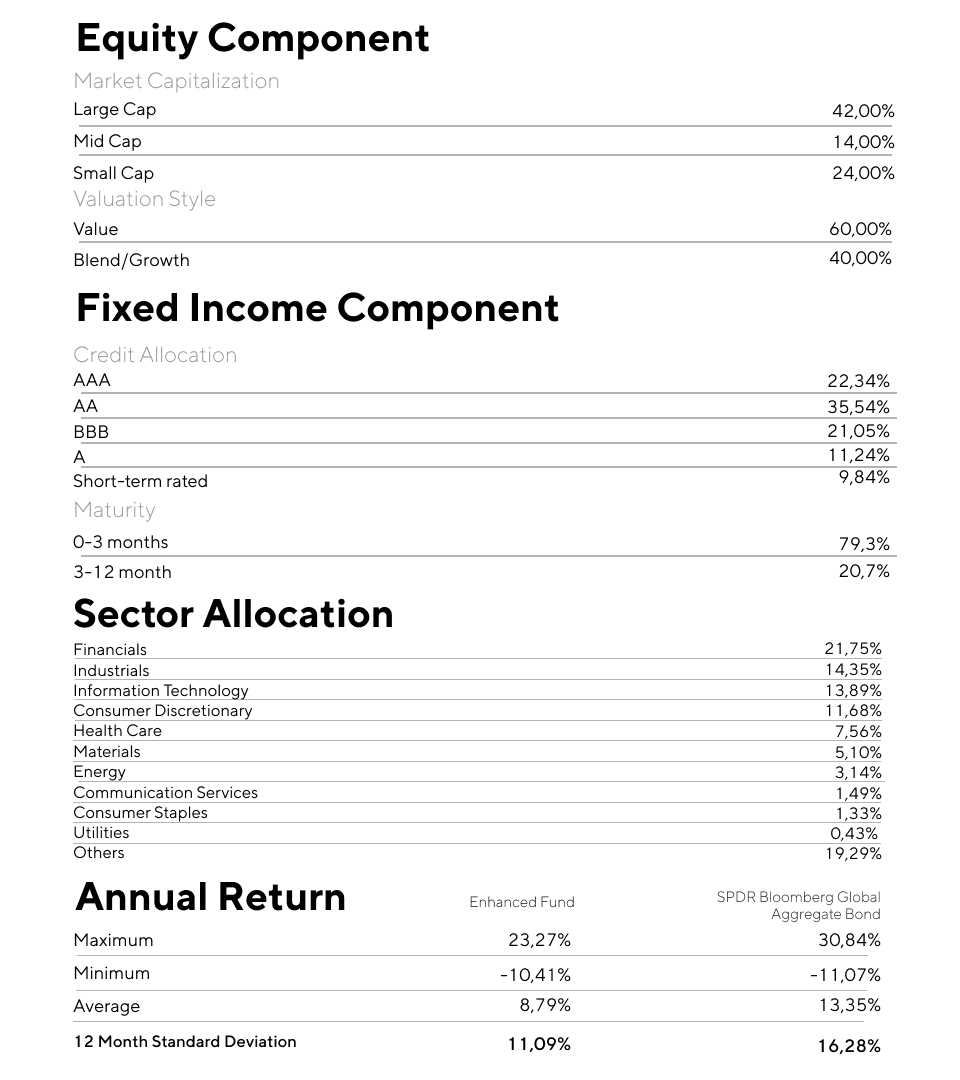

The Enhanced Portefolio

The Enhanced Portfolio combines global debt and equities to achieve long-term growth and stability.

Why Enhanced?

• Growth focus: High equity exposure targets strong capital appreciation over time.

• Risk-return balance: Fixed income cushions volatility but the portfolio remains equity-driven, suitable for investors with higher risk tolerance.

• Diversification: Combines broad equity market participation with income and stability from bonds.

• Ideal for: Investors seeking long-term growth and willing to accept short-term fluctuations.

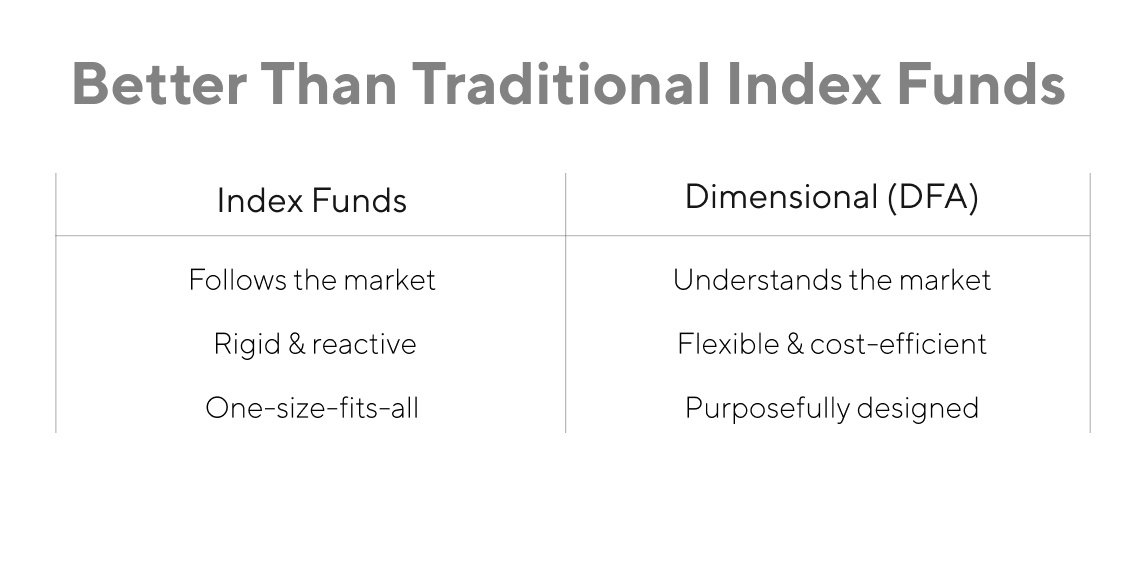

What this means for you:

- Confidence to stay invested during ups and downs

- Smart exposure to areas of higher long-term returns

- A clear plan to grow your wealth over time

Available Only Through Trusted Partners

You can’t buy Dimensional funds directly—they’re only available through approved partners. This means fewer emotional decisions, better planning, and a focus on your long-term goals.

Fund VALORIS (moderated portfolio) is eligible to the Golden Visa Portugal

Golden Visa investors (Program ARI) are eligible exclusively through the Moderate Portfolio, supported by two independent legal opinions.

Returns for Golden Visa investors are paid upon redemption, with liquidity available at any time, subject to a five-working-day settlement period.